Home Loan has initiated a project that incorporates a peer-to-peer loan service that works with cryptocurrency and is secured by real estate. This will promote an easier and more equitable way to take home loans.

About Home Loans

According to The Home Loans whitepaper magazine, more than 1.6 billion people in the world do not have their own homes. Housing is an important part of human livelihood and the housing sector has declined in recent years after the 2008 financial crisis.

Since the 2008 housing bubble, banks have been hesitant and more stringent in terms of providing mortgage loans. There are various aspects to consider before lending to others and the trust of the borrower.

Home loans aim to eradicate a strict credit enrollment policy by introducing a peer-to-peer platform with the help of blockchain. This will give people the opportunity to easily access the loans they need to buy their own homes.

It is not easy for foreigners to get home abroad because sometimes funds are insufficient. In this case, even banks are not willing to provide funds to foreigners because it will prove to be a risk. Moreover, the rules and regulations on credit vary from country to country. This is a project like Home Loans that can help people.

Due to greater accessibility, the home loan platform will be able to attract more customers and therefore will be able to offer a relatively lower interest rate than the bank.

Problems and solutions

Today, there are banks around the world that make it very difficult for non-residents to get home loans in certain countries. This may be due to strict laws and policies that are difficult for governments to do. In some places it is not even possible for non-resident residents to get loans and although they do, they tend to face higher interest rates than residents.

In this day of globalization, where migration for better livelihood is common, it is an integral step to have an easier way to provide home loans to foreigners in countries.

Home Loans is a project that will help provide a much needed solution to this global problem. With a team working in the real estate field for over a decade, it has successfully developed a real estate-focused platform and provides real estate loans to users.

Their main goal behind this is to create an international lending platform using open source resources based on blockchain technology.

How it works

Home Loans will be able to provide loans for housing under construction, loans for secondary housing, loans to commercial real estate, loans for land purchase and loans for own property, through their international lending platform.

They provide a loan for a period of 180 months with an interest rate of an annuity of 1-5%. The borrower's age criteria range from 18 to 65 years. Repayment excludes commissions and starts from the first month as an annuity payment.

With the help of a credit rating system, Home Loans will be able to lend to customers with no credit history and to those who do not have bank accounts, as well as collect large amounts of information.

COUNTIRES WITH BEST EASE OF SECURING MORTGAGE LOAN

• United States of America

Fixed interest rate: 4%

Interest on loans: up to 75%

Loan term: up to 30 years

• Spain

Fixed interest rate: 4-5,5%

Floating Rate: 2%

Interest on loans: up to 80%

Loan term: up to 30 years

• Germany

Fixed interest rate: 3-4%

Interest on loans: up to 50%

Loan term: up to 30 years

• France

Fixed interest rate: 2.5-4%

Interest on loans: up to 60%

Loan term: up to 15 years

• Latvia

• Turkey

Fixed interest rate: 6-8%

Interest on loans: up to 60%

Loan term: up to 15 years

• Cyprus

Fixed interest rate: 5-8%

Interest on loans: up to 60%

Loan term: up to 10-40 years

COUNTRIES WITH DIFFICULTY IN GUARANTEE MORTGA CREDIT

• Czech Republic

Fixed interest rate: 5%

Interest on loans: up to 60%

Loan term: up to 35 years

• Switzerland

Fixed interest rate: 4.5%

Interest on loans: up to 50%

Loan term: up to 10 years

• Australia

Fixed interest rate: 3.5%

Interest on loans: up to 60%

Loan term: up to 25 years

• English

Fixed interest rate: 2-4,5%

Interest on loans: up to 70%

Loan term: from 5 years

• Bulgaria

Fixed interest rate: 11%

Interest on loans: up to 70%

Credit period: up to 25 years

COUNTRIES WITH IMPOSSIBILITY OF MORTGAE SECURING LOANS

• The Netherlands

• Thailand

• Norway

• Japan

• Italy

KINDS OF CREDITS IN HOUSEHOLD PLATFORM

• Loans for secondary housing

• Loans for housing under construction

• Loans for housing under construction • Loans for commercial property

• Loans for own property

• Loans for land purchase

HOUSEHOLD PROJECT SOLUTIONS HOUSEHOLD

• CREDIT HOUSE is the road to the international market

• It creates an international lending platform using open source resources based on blockchain technology

• Provide local investors access to large amounts of data

• It allows investors to; investing in guaranteed real estate loans, giving investors the right to participate in quick transactions, investors will get evidence provided with real assets, give investors the right to buy and use HOME LOANS assets ie real estate that has not been bargained, the investor will get the right to collective loans for large / expensive real estate

• Allows the borrower to get HLCoin for loan repayment

THE BENEFIT OF CREDIT HOME

• Attract new customers and return via HOME LOANS for business.

• Allow people to purchase property without using traditional methods such as banks

• Business scaling

• HOUSE LOANS allow their own repayment payment system without using Fiat money

• Expanding our customer base for private and business investors by creating a crypto ecosystem on our platform.

LOYALTY SYSTEMS ON HOUSEHOLD PLATFORM

HLCoins can be obtained by users from the HOME LOANS platform by doing the following; dinner at your favorite restaurant, go jogging or do any related sport, invite friends to the HOME LOANS platform, invite co-workers to the HOME LOANS platform, and volunteer.

LEGAL HOUSEHOLD TOKEN:

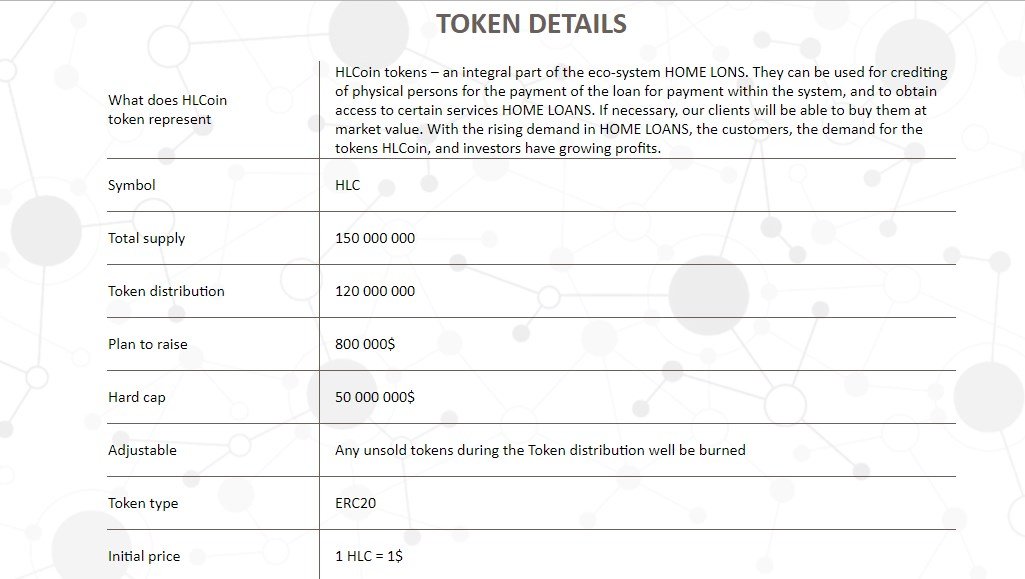

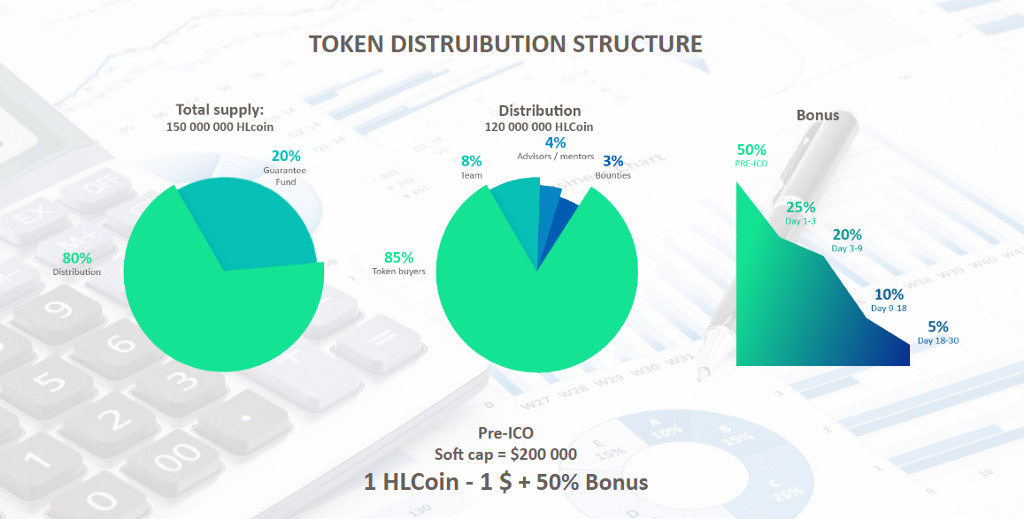

HOME LOANS tokens will be launched on the basis of Ethereal and will use smart contracts. The Pre-ICO HLCoin mark to be the first phase will begin on 29 December and end on 29 December with the price of 1 HLCoin = 0,5 $ (+ 50% bonus). In the second phase of the crowdsale, 150,000,000 HLC tokens will be issued and sold at a fixed price and investors will be activated to purchase HLCoin Token with fixed rate of 1 HLCoin = 1 $ (+ bonus), using US dollar (USD), Bitcoin , Ethereal.

Investors - 85%

Founder - 8%

Advisor - 4% Reward

- 3%

HOUSEHOLD LOANS

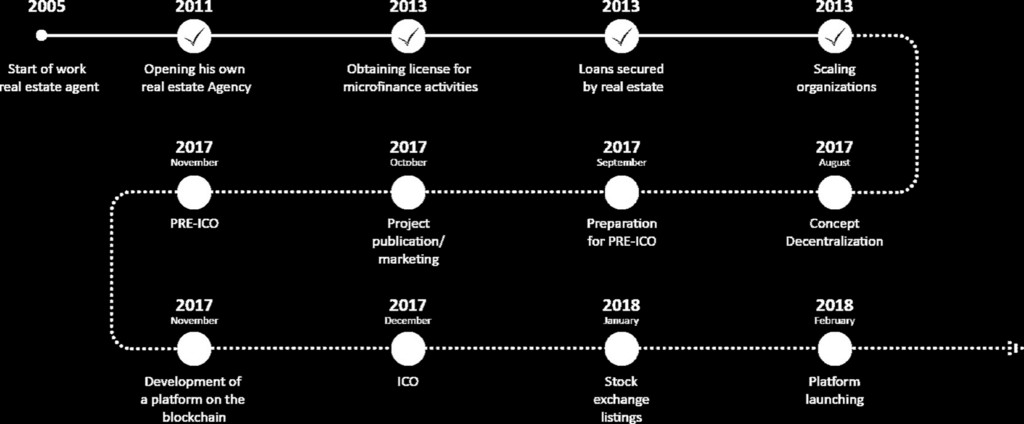

2011 - Opens the real estate agency itself

2013 - Obtaining licenses for microfinance activities

- Loans secured by real estate

- Organization scaling

August 2017 - Decentralization Concepts

September 2017 - Preparation for PRA-ICO

October 2017 - Project / marketing publication

November 2017 - PRE-ICO

December 2017 - Development of platform on blockchain

January 2018 - ICO

February 2018 - List of exchanges

March 2018 - 2020 - Customers first lending ZOOMING WORLDWIDE

HOME LOANS TEAM

Irina Mandrik - CEO & Co-Founder

VyacheslavStrekalev - CIO

Alexander Ermakov - CIO

Sergey Otchesov - CMO

Oleg Milter - CMO

Luba Katz - CFO

For more information about our unique project and to connect with other participants around the world, please click one of the following links;

ANN thread: https://bitcointalk.org/index.php?topic=2479111.0

Website: http://home-loans.io/

Telegram: https://t.me/HomeLoanseng

Twitter: https://twitter.com/HomeLoansCoin /

Facebook: https://www.facebook.com/HomeLoans-1718926604819378/

Whitepaper: http://home-loans.io/White_Paper_ENG.pdf

Author: indah333

Profile link: https://bitcointalk.org/index.php?action=profile;u=1724885

Eth: 0x54fE31f12a304C08833A834E3E60032da3cFf483

Tidak ada komentar:

Posting Komentar