Ceyron Token is something that can be used rather than money. The CEY token is a digital token to be provided to the investor and is a beneficial interest in a class apart from the non-voting equity stake in Ceyron. The CEY Token is a smart and functional utility contract in mutual funds. The CEY Token is non-refundable. This is not for speculative investment.

Ceyron Finance Sarl (CFS) is a limited liability company incorporated under the laws of a limited liability company ("Dana"), and wholly owned by Ceyron Finance Ltd. The CFLS and the IMF have entered into an agreement stipulating the rights of Operations and liabilities of each party.

The funds will be managed and advised by Colombus Investment Management Ltd, ("investment manager"). Columbus Investment Management Ltd., British Virgin Islands is listed as an independent alternative investment management company specializing in alternative assets and global asset allocations. The Fund Manager will be responsible for the operation of the Fund and will perform all services and activities related to managing assets, liabilities, and operating the Fund.

VALENTINE TOKEN VALUE

Investment Objectives and Strategies

The IMF's investment objective is to provide attractive returns on capital invested through a quantitative approach to credit for underwriting assets against ownership, which will be provided by Colombus Investment Management Ltd. will adhere to the IMF-driven investment strategy driven by science data, in which nonparametric statistical model engine learning is applied to the expected financial benefit issue.

The net income earned by the Fund during a given month will generally be retained for, but a substantial portion of revenue from the periodic potential may be used to distribute annual dividends to holders of CEY Token, where dividends are approved by the shareholders and shareholders of the CFL.

CEYRON CARD

The CEY card will become a physical, virtual, and debit MasterCard with a mobile app that will allow the use of twenty (20) foreign currency from one card. In the market for similar lifestyle cards, in addition to the cost per transaction, most cards charge a percentage of the market rate for the spread of currency exchange. Customers traveling to different countries in various currencies will definitely run into "Cash Advance" and "Currency Transaction Fee." These fees are often a percentage of transactions plus fixed costs, industry leading costs are between 2.75% 2.99%.

CARD DEBIT CEYRON

Our cards are published with the capabilities of CHIP, mostly with Contactless technology as well. What does this mean?

CHIP (also called EMV) is a technology to make your debit cards much more secure and very difficult to copy or clone. With a CHIP card, your confidential information is much safer than with magnetic stripe technology and card authorization, like when you buy something, faster, more reliable, and much more secure. This technology is standardized worldwide and your CHIP debit card can be used and compatible anywhere (where Mastercard is accepted).

Contactless (formerly called paypass) is a card technology that allows quick payment for small personal purchases in stores etc. Just by tapping or waving the card in the card terminal. No PIN or signature required for small purchases. There is protection against accidental or multiple payments. Contactless replaces cash for small payouts.

DIGIPASS

In line with the latest technological developments and customer preferences, DIGIPASS Applications; allows clients to authenticate online card transactions safely using their smart phones.

This app can be downloaded for all Android, iOS and Windows smartphones from the official App Store and Google Play Store, making online banking safe and providing more convenience than ever in many ways:

- Secure the modern technology available on your mobile device

- Activation is easy with QR code reading

- Additional security through fingerprint protection (on supported devices)

- No need to bring additional tools to activate online banking

- There is no lifetime limit

- More flexibility for PIN management

- Manage more accounts with one app

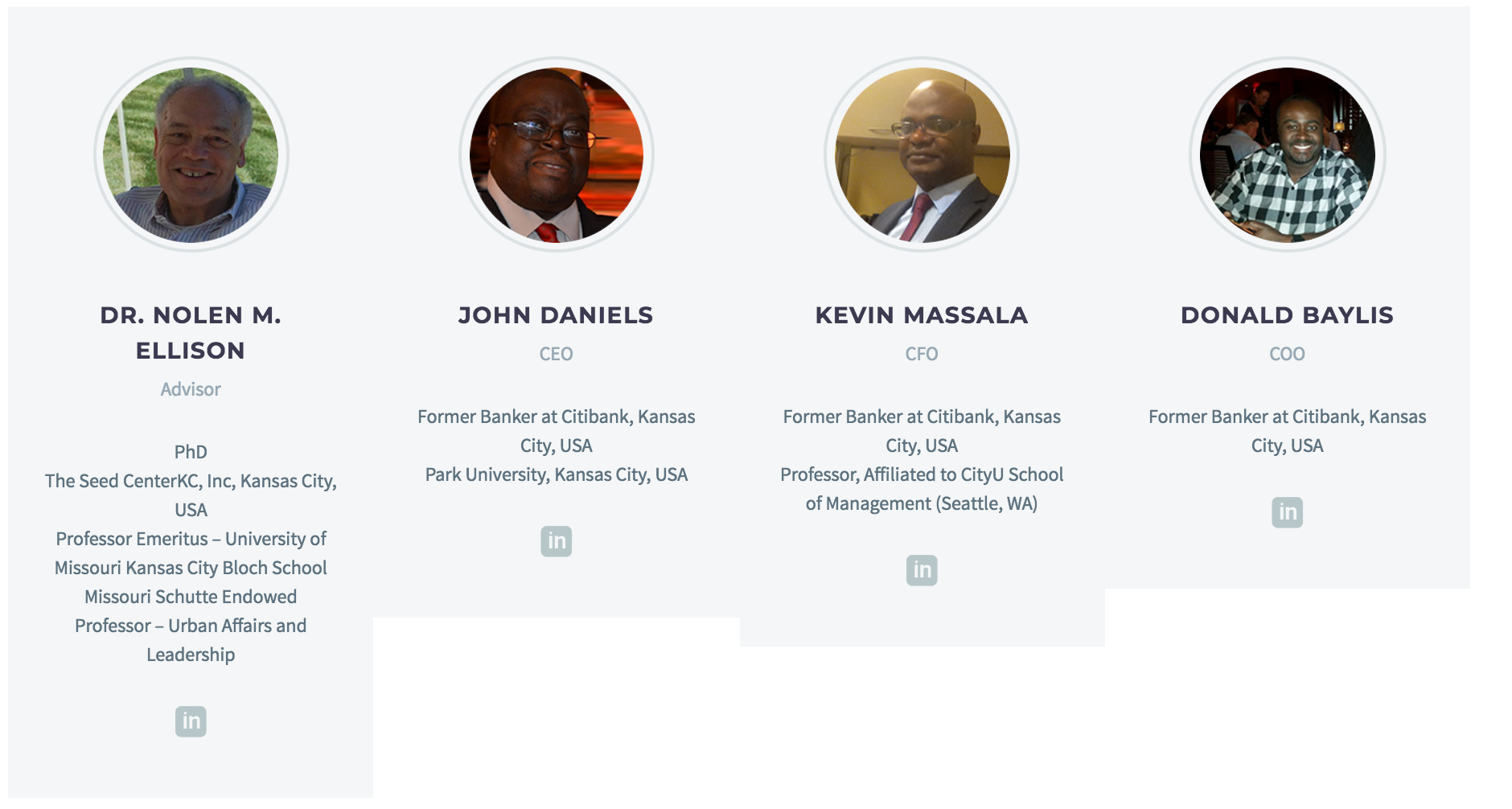

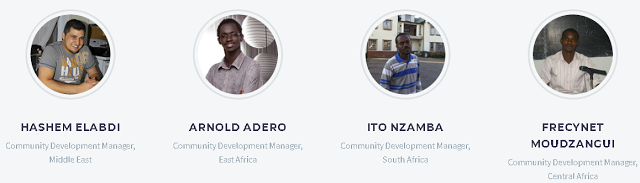

Team Ceyron

FOR MORE INFORMATION :

Website: https://ceyron.io/

Technical Report: https://ceyron.io/wp-content/uploads/2018/02/White-Paper-ICO-CEY-Token-UPDATED31012018.pdf

Facebook: https://www.facebook.com/Ceyron/

Twitter: https://twitter.com/cryronico

Instagram: https://www.instagram.com/cryronico/

Author: indah333

Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=1724885

Eth : 0xf16486c792628e08D0D32995b0EB9e90fea27692

Tidak ada komentar:

Posting Komentar